That’s why it’s important to make sure you keep your bank statements somewhere safe, and always use a shredder when disposing of them. This means that if they do fall into the wrong hands, they could be used for fraudulent activity. Keeping your bank statements secureīank statements include highly personal information, such as your name, account number, and address. Open a free N26 account today to access a host of security features, including fingerprint identification, face recognition, and discrete mode to blur your screen to others when accessing your banking details in public.

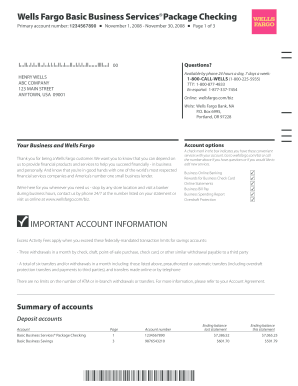

With N26, you can enable push notifications whenever a transaction takes place on your account, so that you can quickly spot any suspicious activity. Reviewing your bank statements regularly can help you spot any unauthorized payments on your account so that you can flag them to your bank right away. Some banks let you opt-in to receive emails with your statements attached, or you can view them directly via your online account or smartphone app.įor quick and convenient access to your bank statements, why not open an N26 account? With N26, your e-statements can be accessed quickly right on your smartphone. Now, with most banks having a digital presence, electronic statements are more commonly used.Į-statements are a convenient way to view your account activity without the messy paperwork, and your financial data is securely stored. Historically, bank statements were sent to customers via post, which sometimes incurred a small service fee. Each transaction will show the date it was processed and may also include some information about who the payment was to or from. Next, you’ll find the full list of transactions made within the statement’s timeframe-essentially all payments that came into your accounts, and all outgoing payments. At the top of the statement, you’ll usually find your account number, the bank branch provider, your full name and home address, as well as the beginning and ending period of the statement.

0 kommentar(er)

0 kommentar(er)